Inclusive FinTech Forum 2026

Registration for IFF 2026 is now closed.

We look forward to welcoming confirmed participants in Kigali.

Inclusive FinTech Forum 2026 starts tomorrow at the Kigali Convention Centre. Badge collection and accreditation start from 9th to 12th March, between 8:30 AM and 6:00 PM.

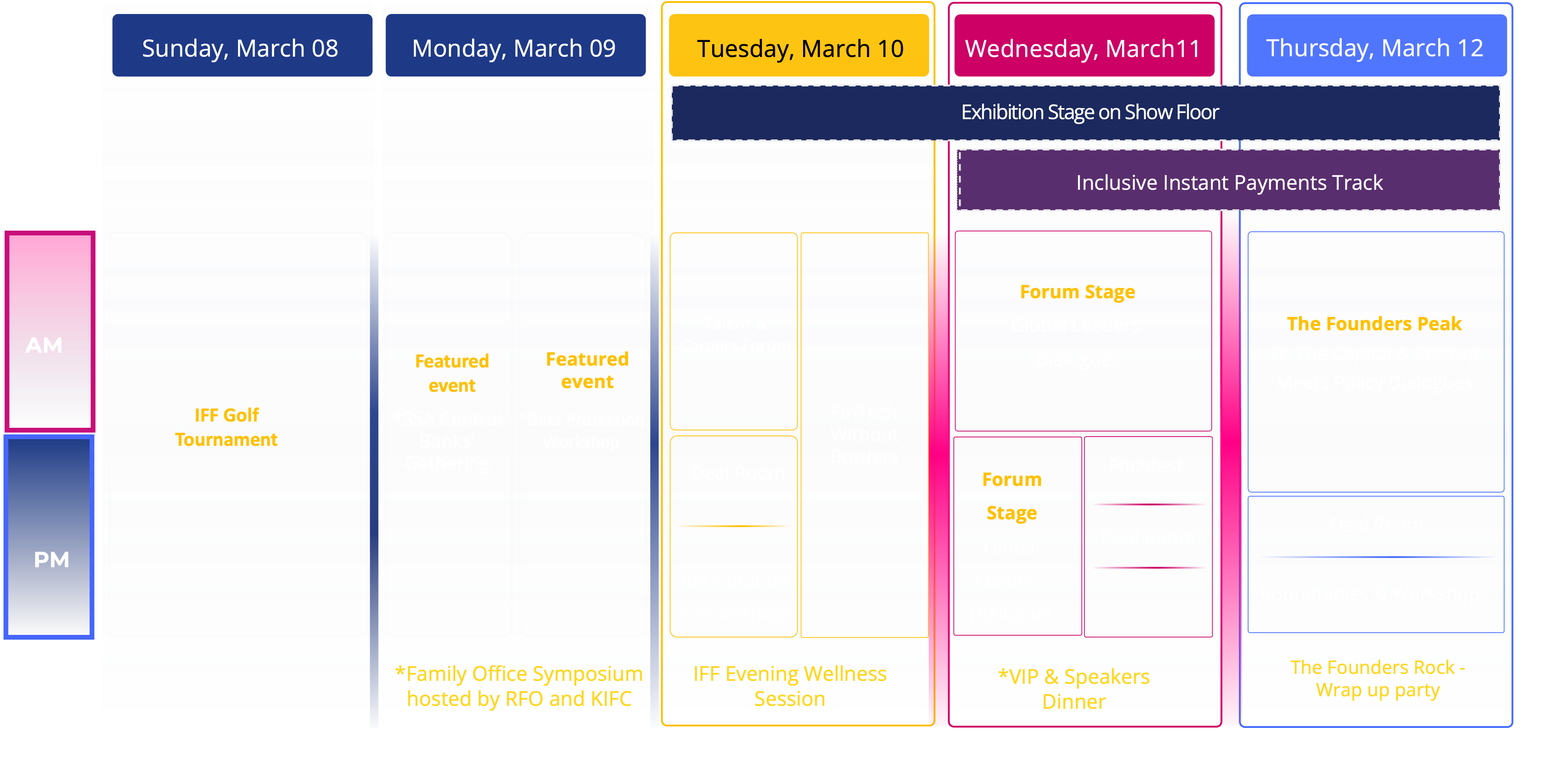

10 – 12 March 2026 | Kigali Convention Centre, Kigali, Rwanda

Registration Closes In

Registration is now closed. See you at IFF 2026 in Kigali!

Get Your 2026 PassThe Inclusive FinTech Forum (IFF) is the global platform that convenes 3,000 leaders, investors & fintechs to participate in impactful dialogues & meetings that will advance policies & regulations, and create meaningful long-term connections & partnerships to advance financial inclusion through fintech for good.

2026 Featured Speakers

-

Carine Umutoni

Managing Director

Ecobank Rwanda

Carine Umutoni

Managing Director

Mrs. Carine Umutoni is the Managing Director of Ecobank Rwanda Plc.

Mrs. Umutoni has over 19 years of experience in banking and has previously served in senior management roles in the banking sector in Rwanda such as Managing Director of BK Capital, Head of Treasury and Trade Finance at Bank of Kigali, Head of Treasury and Institutional Banking at KCB Rwanda and Head of Treasury and Trade Finance at Banque Commercial du Rwanda (BCR), now I&M Bank Rwanda.

She is also a member of the Agahozo Shalom Youth Village.

She is the holder of an MBA in Corporate Strategy and Economic Policy from Maastricht University, Netherlands. -

David Nandwa

Founder & Chief Executive Officer

HoneyCoin

David Nandwa

Founder & Chief Executive Officer

David Nandwa is a serial entrepreneur and CEO @ HoneyCoin, before HoneyCoin he's worked as a software engineer at or with leading companies like Flutterwave and Andela. He's started, scaled, and exited two ventures prior to HoneyCoin and has a passion for finance and building real-world solutions to hard problems on the continent. David has raised millions of dollars in funding from investors such as Visa, TLCom, Flourish Ventures, Antler and more and has scaled HoneyCoin to over $100M per month volume as of 2025.

-

Deon Woods Bell

Senior Advisor, Global Policy & Advocacy

Gates Foundation

Deon Woods Bell

Senior Advisor, Global Policy & Advocacy

Deon Woods Bell is a Senior Advisor, Global Policy and Advocacy at The Gates Foundation. She leads policy and multilateral engagement for the Digital Public Infrastructure and Inclusive Financial Systems teams, representing the foundation across major global institutions including the United Nations, World Bank, G20, and African Union. Earlier foundation accomplishments include spearheading efforts related to the African Continental Free Trade Agreement (AfCFTA) Digital Trade Protocol, South African G20 Digital and Financial Inclusion Working Groups as well as the UN Digital Public Infrastructure Safeguards Initiative. She serves on the foundation's AI Task Force, and her portfolio also includes cross-border policy harmonization related to digital transactions, women’s economic power, artificial intelligence, and cybersecurity.

Deon previously served as attorney-advisor and senior international counsel at the U.S. Federal Trade Commission, leading global consumer protection, privacy and data security technical cooperation and serving as an expert to the United Nations and the Organization for Economic Co-operation and Development (OECD). She also has held positions at the U.S. Department of Commerce, an international law firm, and Fortune 500 companies, with her pro bono work centered on human rights advocacy and environmental justice.

On behalf of the Gates Foundation, Deon serves on advisory bodies including the United Nations Better Than Cash Alliance (BTCA), the World Bank’s Consultative Group to Assist the Poor (CGAP), the Digital Impact Alliance (DIAL), and the UK International Centre for Tax and Development (ICTD). She also serves on the American Bar Association House of Delegates, Center for Innovation Governing Council/AI Task Force, and on advisory boards of the Partnership on Open AI, American University’s School of International Service, and the Smithsonian Women’s Committee.

Deon earned her J.D. from the University of Chicago Law School, where she served on the Law Review. She holds a Master’s in Economics from the University of Michigan and a triple-major B.A., cum laude (International Relations, Economics, and Latin American Studies), from American University. She was a Fulbright Scholar and completed advanced study in Political Economy and Government at Harvard University. She was proudly a U.S. election monitor during President Nelson Mandela’s historic election in South Africa.

Deon speaks Spanish, French, and Sign Language. She has lived, worked, and traveled extensively across Africa, Asia, Europe, Latin America, and the Middle East. In her spare time, she enjoys dancing, reading, listening to podcasts, and enthusiastically supporting her three children’s soccer, basketball, and volleyball teams. -

Fadilah Tchoumba

Chief Executive Officer

ABAN

Fadilah Tchoumba

Chief Executive Officer

Fadilah Tchoumba is the CEO of ABAN and the fund manager for Catalytic Africa, a co-investment facility for early-stage startups in Africa. She also serves as the Director of the African Business Angel Vehicle, a fund focused on sector-specific ventures. Additionally, Fadilah is a founding member and senior analyst at Amzill, a data collection and analysis firm, and she is on the advisory board of ENRICH in Africa.

Before joining ABAN, Fadilah managed investment portfolios for institutional investors with interests in African trade. She also served as Director of Business and Innovation for the Royal Commonwealth Society, where she led the development of innovative projects aligned with Commonwealth values.

Fadilah has been instrumental in creating tech-driven funds for innovative startups, including sharia-compliant vehicles, establishing herself as a leader in alternative asset classes in Africa. Passionate about innovation and sustainability, she advocates for early-stage investing, cross-border investments, and policy development to drive success in Africa’s entrepreneurial ecosystem.

Fadilah holds a BA in Economics and Philosophy from Connecticut College, a diploma in International Commerce and Trade from Georgetown University, and a Master’s degree from the London School of Economics. -

Henry Saamoi

Executive Governor

Central Bank of Liberia

Henry Saamoi

Executive Governor

Mr. Henry F. Saamoi is a distinguished commercial banker with over twenty-five years of industry experience. His career commenced in 1998 as an intern at the Liberia Bank for Development and Investment (LBDI). He subsequently transitioned to the International Trust Company (ITC) to complete his internship. Following his graduation from the University of Liberia in 1998, he secured a permanent position in 1999 with ITC as a Staff Analyst in the Finance & Accounting Department of ITC's Maritime & Corporate programs. It is noteworthy that in 1999, ITC was dissolved, and its Banking Department was rebranded as International Bank (Liberia) Limited.

In 2000, Mr. Saamoi was rehired as a Senior Financial Analyst in the Finance Department of International Bank (Liberia) Limited (IBLL). Demonstrating exceptional skills and leadership, he rapidly ascended through various roles within the bank and was appointed as the Chief Executive Officer (CEO). He officially retired as CEO of IBLL on May 31, 2024. His retirement comes after nearly twelve successful years at the helm, following a special dispensation from the Central Bank that allowed him to continue serving beyond the standard ten-year tenure required by the CBL Corporate Governance Regulation.

He has been recognized with prestigious awards, including the Industry Personality of the Year in Banking at The Africa Summit Awards in London in 2018, presented by the African Leadership Magazine. Additionally, he is the proud recipient of the Distinguished Banking Personality Excellence Award, which he received at the African Leadership Magazine's Persons of the Year Awards Ceremony, held in Addis Ababa, Ethiopia, on March 14-15, 2024.

Under his leadership at International Bank (Liberia) Limited (IBLL), IB was recognized by Banker International Magazine as the Best Innovation in Retail Banking and the Best Commercial Bank in Liberia at the 2018 Banking Awards, held at the London Stock Exchange in London.

He is a graduate of the School of Banking, University of Wisconsin in Madison, USA. He holds certificates in International Finance Reporting Standards (IFRS) and Trade Finance from the International Finance Corporation, complemented by his participation in several prestigious workshops organized by the World Bank, both within Liberia and internationally. Until his retirement on May 31, 2024, he served as the Vice President of the Liberia Bankers Association, showcasing his leadership and expertise in the banking sector.

On July 30, 2024, Mr. Saamoi was appointed by His Excellency, Ambassador Joseph Nyuma Boakai, Sr., President of the Republic of Liberia, to serve as Acting Executive Governor of the Central Bank of Liberia and was appointed Executive Governor on February 5, 2025. -

Hilda Moraa

Founder & Chief Executive Officer

Pezesha

Hilda Moraa

Founder & Chief Executive Officer

Hilda is an award-winning entrepreneur and author. She has more than 15 years of entrepreneurship experience in Fintech and working with multinationals supply chain firms like Coca-Cola to develop innovations across Africa. She is a unique forerunner in many ways, including the fact that her first tech start-up was the first recorded multi-million dollar exit in the Kenya ecosystem – way back in 2015. This exit catapulted the ecosystem as entrepreneurs and techies saw what was possible. She is currently the Founder & CEO of Pezesha, a holistic digital financial infrastructure powering working capital and credit scoring to SMEs and institutions across Africa. Pezesha is using more than 100 million points of data, and has disbursed over 500,000 SME loans. She has been profiled by Bloomberg as one of the Bloomberg LP New Economy Catalysts in 2023. Most recently in early 2024, she was awarded the winner of the Tech & Innovation by Forbes Woman Africa. She is also the newly appointed UN (United Nations) UNCTAD, - eTrade for Women Advocate for English-speaking, Africa region 2024-2025.

-

Hortense Mudenge

Chief Executive Officer

Kigali International Financial Centre

Hortense Mudenge

Chief Executive Officer

Hortense MUDENGE is the Chief Executive Officer of Kigali International Financial Centre, the agency promoting and developing Rwanda as a leading financial destination for international investment and cross-border transactions in Africa.

Hortense is a seasoned management consultant, with over 12 years of experience in private sector development and finance.

Hortense holds an MBA from Hult International Business School in the US and is a graduate of the United States International University- Africa. -

Innocent Kawooya, NIM

Chief Executive Officer

HiPipo

Innocent Kawooya, NIM

Chief Executive Officer

My name is Innocent Kawooya, NIM, a co-founder and CEO of HiPipo, a digital innovation and financial inclusion company founded in 2005. HiPipo is a leading champion of digital and financial inclusion across Africa and is widely recognised for advancing Instant, Inclusive Payment Systems (IIPS) under the HiPipo Include Everyone Program, working with governments, regulators, FinTechs, and development partners across the COMESA region and beyond.

I am a FinTech and financial inclusion specialist, women empowerment advocate, internet entrepreneur, computer programmer, film producer, humanitarian, and entertainment executive. In 2021, I stood as a Kampala City Lord Mayoral candidate, driven by a vision of inclusive urban development and digital transformation.

I have received multiple recognitions for leadership and impact, including CEO of the Year 2021–2022 by TIG Network Afrika and FinTech CEO of the Year (MEA Region) for 2024 and 2025. In October 2024, I was awarded the Presidential Diamond Jubilee, National Independence Medal by H.E. the President of Uganda for contributions to digital and financial inclusion. In 2023, the Mojaloop Community Council voted me Co-Chair for the second time in three years.

HiPipo has been ranked among the World’s Top 20 Companies Escalating Innovation in Digital Financial Services by Global Business Leaders Magazine and named Best Financial Inclusion Organisation in East Africa at the FinTech Awards 2022 and 2023, and awarded Financial Inclusion Organisation of the Year in the MEA Region for 2024 and 2025 by Wealth & Finance International.

Through initiatives such as Digital Impact Awards Africa (DIAA), HiPipo Music Awards, Women in FinTech, 40 Days 40 FinTechs, My Doctor (telemedicine), Solar M7 (clean energy access), and HiPipo University, my work focuses on building practical, scalable solutions that expand access to health, finance, energy, education, wealth and opportunity for millions of people across Africa.

#MadeOfGOD -

Kosta Peric

Deputy Director, Inclusive Financial Systems

Gates Foundation

Kosta Peric

Deputy Director, Inclusive Financial Systems

Experienced executive at the intersection of technology, finance and innovation. Focus on digital financial inclusion at the Gates Foundation. Board chair at the Mojaloop Foundation and board member at the Interledger Foundation. Former Chief Architect at Swift. Author: The Castle and the Sandbox.

-

Marcus Davis

Deputy Director

Central Bank of Liberia

Marcus Davis

Deputy Director

Marcus N. Davis is Deputy Director of the Payment Systems Department at the Central Bank of Liberia (CBL). He plays a central role in driving Liberia’s payments modernization agenda, including the implementation of the National Electronic Payment Switch (NEPS) to achieve cross-domain interoperability. Marcus leads stakeholder coordination with mobile network operators, financial institutions, and international partners. His work is focused on advancing financial inclusion, improving digital public infrastructure, and strengthening payment system oversight. With extensive experience in financial services, policy, and program delivery, Marcus is passionate about building secure, inclusive, and sustainable digital finance solutions for Liberia.

-

Mary Ellen Iskenderian

President & Chief Executive Officer

Women's World Banking

Mary Ellen Iskenderian

President & Chief Executive Officer

Mary Ellen Iskenderian is the President and CEO of Women’s World Banking, a global nonprofit dedicated to serving the nearly one billion women excluded by the formal financial sector. She joined Women’s World Banking in 2006 and leads its global team in partnering with financial institutions and policymakers around the world to design and develop solutions and programs that facilitate systemic change for women. Additionally, she oversees Women’s World Banking’s asset management business that makes direct equity investments in financial service providers as a means to advance women in the workplace and as customers.

Mary Ellen is a passionate advocate for women’s economic empowerment through greater access to finance; she urges the financial services industry and business community to view low-income women as a powerful new market of small business owners, heads of households, and consumers of financial products and services.

Mary Ellen has spoken widely and published extensively on topics ranging from equality of economic opportunity, women’s financial inclusion, climate resilience, and financial abuse. In April 2022, her first book, “There’s Nothing Micro About a Billion Women: Making Finance Work for Women,” was published by MIT Press.

Before joining Women’s World Banking, Mary Ellen worked for 17 years at the International Finance Corporation, the private sector arm of the World Bank, and had previously worked for the investment bank Lehman Brothers. She is a permanent member of the Council on Foreign Relations, serves as a Director on the Board of the William and Flora Hewlett Foundation, and is a member of the World Economic Forum’s Global Future Council and of Milken’s Africa Business Leaders Council.

A 2017 Rockefeller Foundation Bellagio Center Fellow, Mary Ellen holds an MBA from the Yale School of Management and a Bachelor of Science in International Economics from Georgetown University’s School of Foreign Service. -

Natalie P. Jabangwe

Chief Executive Officer

Timbuktoo Africa Innovation Foundation

Natalie P. Jabangwe

Chief Executive Officer

Natalie Jabangwe is the CEO of the Timbuktoo Foundation, that houses a $1bn start up fund, a leading organization focused on driving innovation across Africa. Under her leadership, the foundation has become a key player in empowering young innovators and entrepreneurs, fostering creativity, and promoting sustainable development through technology and education.

Before joining Timbuktoo, Natalie served as the Group Digital Executive Officer at the Sanlam Group, Africa’s largest non-bank financial company in Africa and overseeing 34 countries and a budget of $600m. From 2014-2021, she was CEO of EcoCash, Zimbabwe’s largest mobile money service, where she was one of the youngest female CEOs in Africa’s mobile financial sector. Her career has been marked by her commitment to leveraging technology to create impactful solutions, earning her recognition as a Young Global Leader by the World Economic Forum in 2018. Natalie is also a 2017 Oxford University Tutu Fellow, reflecting her leadership and influence across Africa. -

Ola Oyetayo

Co-Founder

Verto

Ola Oyetayo

Co-Founder

Ola Oyetayo is the Co-Founder and CEO at Verto. With a robust background in finance, consulting, and entrepreneurship, Ola’s career includes significant roles at American Express, Barclays, and Lloyds Bank.

Ola’s educational journey began in Nigeria, where he completed his early education. He then studied Economics and trained as an Accountant.

Ola was inspired to found Verto by the challenges he observed some of his friends facing when making international business payments. It became apparent that businesses located in emerging markets often encountered difficulties in executing seamless cross-border transactions. Always drawn to solving large-scale problems, Ola gravitated towards addressing this issue, leading to the establishment of Verto with the vision to facilitate smoother global commerce.

Under Ola’s leadership, Verto was awarded the Fintech of the Year 2022 at the London Fintech Awards. Outside of work, Ola enjoys reading and playing golf. -

Dr. Patrick Njoroge

Former Governor

Central Bank of Kenya

Dr. Patrick Njoroge

Former Governor

Dr. Patrick Njoroge served as the ninth Governor of the Central Bank of Kenya from June 2015 to June 2023, after a 20-year career at the International Monetary Fund. He is currently a member of the Advisory Boards of the "Yale Program on Financial Stability" and the "Global Finance and Technology Network," chair of the "Africa Financial Industry Summit" (AFIS) Supervisory Council, and a member of the Africa Expert Panel for South Africa’s G20 Presidency. He has received several awards and recognitions, including four awards for Africa’s Central Banker of the Year, and recognition in 2023 as a Top 25 African Finance Leader. He holds a PhD in Economics from Yale University. He is MLK, Jr. and Phyllis Wallace Visiting Scholar at the MIT Sloan School of Management.

-

Hon. Paula Ingabire

Minister of ICT & Innovation

Republic of Rwanda

Hon. Paula Ingabire

Minister of ICT & Innovation

Paula Ingabire is Rwanda’s Minister of ICT and Innovation. Before she was appointed Minister, she served as Head of the Technology portfolio under the Rwanda Development Board (RDB) where she led the implementation of National ICT programs notably eGovernment and Cyber Security. She also served as the coordinator of the Kigali Innovation City Project, a flagship program of the Government designed to nurture and strengthen a Pan-African Innovation eco-system in Rwanda.

Minister Ingabire coordinated the creation of Smart Africa, an initiative that seeks to drive coordinated digital transformation across African member states that are part of the Smart Africa Alliance. Today, Smart Africa has 40 African member states that have joined the Alliance.

A graduate of the Massachusetts Institute of Technology’s School of Engineering & Sloan School of Management, in the System Design and Management program; Paula was named among the young Global Leaders in 2020. She serves on the WEF Board of Trustees, Global Council of the World Summit Award Board of Directors, World Economic Forum Cyber Security Board, the Centre for the Fourth Industrial Revolution Global Network Advisory Board, and she serves as a founding board member of the EDISON Alliance. -

Sabine F. Mensah

Deputy Chief Executive Officer

AfricaNenda Foundation

Sabine F. Mensah

Deputy Chief Executive Officer

Sabine F. Mensah has over 25 years of leadership experience in financial inclusion, digital payment systems and mobile money across multilaterals and the private sector in Africa, US, and Canada. Since July 2021, as the Deputy CEO, Sabine oversees AfricaNenda’s policy, advocacy, and capacity development efforts through strategic partnerships, convenings and thought leaderships. Prior to AfricaNenda, Sabine served 6 years as Regional Digital Hub Manager for the United Nations Capital Development Fund UNCDF in West and Central Africa, working on financial inclusive and digital economy. She successfully drove UNCDF’s global digital infrastructure workstream during her tenure. Sabine also consulted for the mobile money industry in Africa working with telecommunication groups and DFS consulting firms on projects accross Africa. She built 15 years expertise in the remittance industry in Africa, US, and Canada with the Western Union Company. As the Regional Director responsible for domestic and international remittances at Western Union Canada, she specialized in agent network management and remittance product design. Sabine is a Certified Digital Finance Practitioner by DFI, and an alumna of the Institut Franco-Américain de Management in France and Central Michigan University in the US. She is bilingual English-French.

-

Dr. Segun Aina

President

Africa FinTech Network

Dr. Segun Aina

President

Dr Segun Aina is a global professional banking leader, internationally rated fintech ecosystem builder and respected futurist.

With three decades of distinguished banking career in three banks including six-year tenure as Bank Chief Executive Officer, Dr Aina is the inaugural Chairman of Global Banking Education Standards Board (GBEStB), former Chairman of Accion Bank Nigeria, Odua Investment Co Ltd, former Director of First Atlantic Bank Ghana, among other past board positions. He served as 17th President of Chartered Institute of Bankers of Nigeria.

He is the founding President and currently Chairman, Board of Trustees of Fintech Association of Nigeria (FINTECHNGR), founding President of the Africa Fintech Network (AFN) , founding member of the Board of Global Fintech Alliance and pioneer Chairman of International Digital Economies Association (IDEA)

In these roles, he has championed, coordinated, and led advocacy and initiatives aimed at improving financial and payment systems, banking regulations, financial literacy and innovation in financial services across Africa and globally.

As an innovation ecosystem builder, Dr Aina who has been variously described as Africa's Fintech Grandmaster, has incubated a number of successful fintech startups and sits on the Boards of various institutions in Banking, Insurance, Agriculture and Technology sectors. He also serves as a member of the UK- Africa Fintech Investment Group, a UK Govt initiative.

Dr Aina's unique contributions to the academic sector includes membership of the pioneer Advancement Board of Obafemi Awolowo University and currently Chairman Advancement Board of Federal University of Technology Akure, co-Chairman National Think Tank on Research for Innovation and Policy (initiative of University of Ibadan Research Foundation of which he is a member) and Member, Osun State University Advancement Board.

Dr. Aina is a distinguished alumnus of University of Lagos and University of Ibadan and had executive business education in INSEAD France, Harvard Business School (HBS), IMD Switzerland, and the Lagos Business School (LBS). He is Fellow of London Institute of Banking and Finance, Chartered Institute of Bankers of Nigeria, Charteted nstitute of Directors, Institute of Chartered Arbitrators among others.

He holds the Nigeria National honours of Officer of the Order of Federal Republic (OFR) since and has received honorary doctorate degrees from four renowned Universities. -

Serigne Dioum

Chief Executive Officer

MTN Fintech Group

Serigne Dioum

Chief Executive Officer

Serigne Dioum is the Group CEO of MTN Group Fintech, where he leads the company’s mission to build Africa’s largest and most inclusive digital financial services platform. Since joining MTN in 2009, he has driven the expansion of MTN MoMo to 14 African countries, serving over 63 million customers and enabling transactions worth over US$212 billion in the first half of 2025. Under his leadership, MTN Fintech achieved a landmark US$5.2 billion valuation through a strategic partnership with Mastercard. A telecommunications engineer by training, Serigne is passionate about using digital innovation to drive financial inclusion and economic growth across Africa.

-

Sopnendu Mohanty

Group Chief Executive Officer

Global Finance & Technology Network (GFTN)

Sopnendu Mohanty

Group Chief Executive Officer

Sopnendu Mohanty is the Co-founder and Group CEO of the Global Finance & Technology Network (GFTN), a global advisory and investment firm. At GFTN, he leads innovative strategies that drive development and transformation in the financial sector through four operating arms: Forums, Advisory, Platform, and Capital.

He served at the Monetary Authority of Singapore (MAS) as its first Chief Fintech Officer for nearly a decade, establishing Singapore on the global map as a leading center for innovation in the financial sector and a dynamic hub for fintech development. He continues to advise MAS on technology and innovation.

He currently serves on several boards, including the board of A*STAR, Singapore’s leading public sector agency dedicated to advancing scientific discovery and technological innovation. Before his leadership role in the public sector, he spent nearly two decades at Citigroup. He is credited with developing many public goods, including the notable PayNow, Singapore’s digital public infrastructure for payments. He conceptualized the globally well-known Singapore Fintech Festival and its global network of forums; today, the GFTN forum is the world’s largest convenor of tech, policymakers, and the financial sector community. Mr. Mohanty has co-authored several patented works in digital finance and received numerous industry accolades. He advises governments and various institutions on policies and implementation strategies for innovation, infrastructure, and ecosystem development in the financial sector. -

Hon. Soraya Hakuziyaremye

Governor

National Bank of Rwanda

Hon. Soraya Hakuziyaremye

Governor

Hon. Soraya Munyana Hakuziyaremye was appointed Governor of the National Bank of Rwanda on February 25th, 2025. Prior to this role she was Deputy Governor of the National Bank of Rwanda since March 15, 2021. Hon. Soraya was also appointed as Chair of the Alliance of Financial Inclusion (AFI) Board of Directors on September 3rd, 2025.

She served as Minister of Trade and Industry from October 2018 to March 2021, in Rwanda, where she led the implementation of the Made in Rwanda policy, contributing to a 9% average annual growth in the industry sector and a significant increase in exports. During her tenure, she also chaired the EAC Sectoral Council on Investment and Trade, playing a key role in the entry into force of the African Continental Free Trade Area Agreement (AfCFTA). Additionally, she was a member of Rwanda’s National COVID-19 Taskforce, overseeing the management of domestic and cross-border trade flows during the pandemic.

Before joining the Cabinet, Hon. Soraya held several senior roles in international banking and finance. From 2016 to 2018, she was Vice President in the Financial Institutions/Financial Markets Risk Department at ING Bank in London. She also previously worked in senior risk management positions at BNP Paribas Group in Paris, Fortis Bank, and the Bank of New York Mellon in Brussels between 2002 and 2011. From 2012 to 2014, she served as Senior Advisor to the Minister of Foreign Affairs in Rwanda.

In addition to her leadership in finance and government, Hon. Soraya has played an active role in corporate governance and investment initiatives. She was a Board member at Ngali Holdings and co-founded the Brussels-Africa Hub, an international non-profit organization led by banking and finance professionals to facilitate sustainable and responsible investments in Africa.

Hon. Soraya brings rich leadership experience in global banking and financial advisory, combining expertise in financial markets, risk management, and economic policy. She holds a postgraduate degree in International Management from the Thunderbird School of Global Management at Arizona State University (U.S.) and a Master’s in Business Engineering (Ingénieur de Gestion) from the Solvay Business School at the Université Libre de Bruxelles (Belgium). She is also an alumna of the Executive Public Leaders Program at the University of Oxford’s Blavatnik School of Government. -

Steve Haley

Director of Market Development & Partnerships

Mojaloop Foundation

Steve Haley

Director of Market Development & Partnerships

Steve has led diverse impact-driven teams for 22 years in over 10 countries between work in the government, non-profit and the private sector. He aims to influence a more equitable and fair world, particularly through inclusive financial services. At the Mojaloop Foundation, he is driving interoperable real time payments that reach everyone by helping various stakeholders to understand their role in building locally owned, locally controlled, and locally operated payments infrastructure. He holds degrees in Mathematics from West Point and the University of Padova.

-

Yemi Keri

Co-Founder

Rising Tide Africa & Heckerbella Limited

Yemi Keri

Co-Founder

Yemi Keri is a technology executive, board leader, and angel investor with over 24 years of experience shaping digital transformation, innovation, and investment across Africa’s public and private sectors. Recognized as one of Nigeria’s foremost women in technology, she has consistently delivered solutions that drive business growth, socio-economic development, and increased participation of women in early-stage investing.

She is the Co-Founder of Rising Tide Africa, a women-led platform advancing cross-border angel investing and investor mentorship, and the CEO of Heckerbella Limited, a technology solutions company delivering scalable and sustainable IT innovations across the continent. Through these roles, she champions education, strategic collaboration, and indigenous digital transformation initiatives.

Yemi serves on the boards of First City Monument Bank (FCMB), Investment One Financial Services, GAIA Africa, Beyond Credit Limited, Nigeria Climate Innovation Centre, and M&E Kaiser Limited.

She is the President of the Nigerian-German Chamber of Commerce (NGCC), President of the African Business Angel Network (ABAN), Chair of the Board of Governors of the Lagos Angel Network, and a member of the Investment Committee of Acumen’s Resilient Agriculture Fund (ARAF).

In academia and mentorship, Yemi is an Expert-in-Residence at the Enterprise Development Centre (EDC) and a facilitator on Corporate Governance and Digital Technology & Trends at Pan-Atlantic University/Lagos Business School. She continues to mentor digital and technology-enabled startups across Africa, shaping the next generation of leaders and investors.

Inclusive FinTech Forum 2026 in Numbers

0

Confirmed registrations

0

Countries

0

Speakers

0

Central Banks

Present

0

Government

Institutions

0

Fintech

0

Financial Institution

0

Higher Education

2026 Forum Overview

Exhibition Stage on Show Floor

shaping inclusive financial systems across Africa and emerging markets. Meet

startups, scale-ups, financial institutions, and global technology leaders

showcasing deployable innovations driving real-world impact, interoperability,

and sustainable financial inclusion.

Thursday 12th March

Inclusive Instant Payments System (MojaCom)

growth phase. This track convenes regulators, infrastructure providers, and

innovators to explore interoperability, digital public infrastructure, and scalable

payment rails enabling seamless, affordable, and inclusive transactions across

borders.

Friday 13th March

IMF-BNR Event on Interoperability in Africa

By Invitation Only

By invitation only.

.png)

Talent & Careers Forum

Talent Shaping Africa's Growth

The Talent & Careers Forum at the Inclusive FinTech Forum is a dedicated space for aspiring professionals, seasoned experts, and fintech enthusiasts to explore career opportunities in the ever-evolving fintech industry. This stage brings together industry leaders, HR professionals, and trailblazers to discuss the skills, trends, and pathways shaping the future workforce in fintech. Through keynotes, panels, and mentorship sessions, attendees will gain insights into building impactful careers while contributing to a more inclusive financial ecosystem.

Forum Stage - Global Leaders' Dialogues

Keynotes & Panels

dialogue. Heads of State, central bank governors, regulators, investors, and

industry leaders address the future of inclusive finance spanning policy, AI, capital

markets, digital assets, and financial stability across Africa and emerging markets.

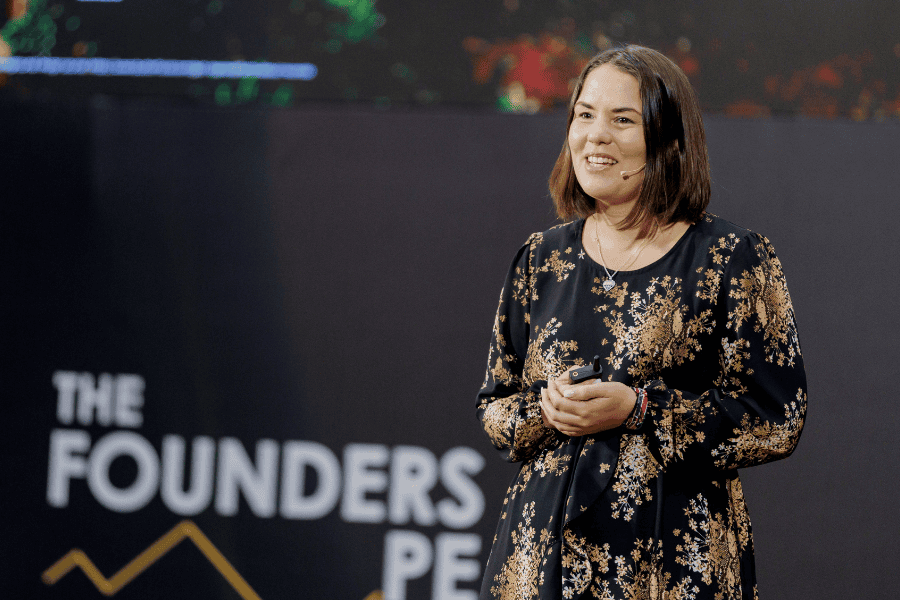

The Founders Peak™

ft. The Startup Meets Policy Dialogues

Through candid conversations with investors, policymakers, and experienced

founders, participants gain practical insights on regulation, funding, growth, and

building resilient fintech businesses.

Data Protection, Privacy & Financial Services Project Workshop

By Invitation Only

The cross-regulatory workshop is the first in a series of three and sets the stage for deeper engagement in subsequent sessions. It will bring together regulators and global experts to share experiences, identify coordination challenges, and explore actionable pathways for alignment

FinTech Without Borders

Financial Innovation Uncovered

interoperability. Leaders from central banks, fintechs, governments, and global

institutions explore solutions that enable seamless cross-border trade, digital

currency corridors, and inclusive global financial connectivity.

.png)

Digital Public Infrastructure

Shaping How FinTech Ecosystems Scale

Roundtables & Workshops

Thursday 12th March

.png)

IFF VIP Drinks Reception with Hercle & Tether

By Invitation Only

Enjoy insightful conversations and networking opportunities with leaders in digital financial infrastructure from 6pm-9:30pm, immediately following the day's final session of IFF on March 10th.

This is a curated gathering - please RSVP early as spaces are limited.

To join the event, please register below:

https://luma.com/dqvxxwn3

VIP Dinner

By Invitation Only

and partners. Designed for strategic relationship-building, the evening enables

meaningful dialogue, trust-building, and collaboration in a private, high-level

setting.

Wrap Party

ft. The Founders ROCK™

regulators, and business leaders jam together on stage to wrap up and celebrate

the Inclusive FinTech Forum 2026!

Evening Wellness Session

2025 Themes

2025 Forum Overview

2025 Guest of Honour

.png?width=500&height=500&name=H.E.%20Paul%20Kagame%20(1).png)

H.E. Paul Kagame

President

Republic of Rwanda

H.E. Paul Kagame

President

Paul Kagame is the President of the Republic of Rwanda. He serves as the African Union (AU) Champion for Domestic Health Financing.

President Kagame previously served as the Commonwealth Chair-in-Office for two years from 2022. He also Chaired the African Union from 2018 to 2019 as well as the East African Community from 2018-2021.

Beginning in 1990, as commander of the forces of the Rwandan Patriotic Front (RPF), he led the struggle to liberate Rwanda. The RPF halted the Genocide against the Tutsi in 1994, which claimed over a million victims.

The hallmarks of President Kagame’s administration are peace and reconciliation, women’s empowerment, promotion of investment and entrepreneurship, and access to information technology, a cause he also champions as Co-Chair of the Broadband Commission for Sustainable Development.

.png?width=500&height=500&name=H.E.%20Paul%20Kagame%20(1).png)

H.E. Paul Kagame

President

Republic of Rwanda

Paul Kagame is the President of the Republic of Rwanda. He serves as the African Union (AU) Champion for Domestic Health Financing.

President Kagame previously served as the Commonwealth Chair-in-Office for two years from 2022. He also Chaired the African Union from 2018 to 2019 as well as the East African Community from 2018-2021.

Beginning in 1990, as commander of the forces of the Rwandan Patriotic Front (RPF), he led the struggle to liberate Rwanda. The RPF halted the Genocide against the Tutsi in 1994, which claimed over a million victims.

The hallmarks of President Kagame’s administration are peace and reconciliation, women’s empowerment, promotion of investment and entrepreneurship, and access to information technology, a cause he also champions as Co-Chair of the Broadband Commission for Sustainable Development.

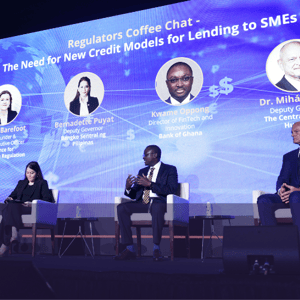

See What Others Have Said About the Forum

See What Others Have Said About Forum

.jpg)

"As someone focused on digital financial solutions for underserved communities, I find the Inclusive FinTech Forum invaluable for discovering innovative approaches to financial inclusion. The forum connects philanthropic organisations with startups and regulators, accelerating impactful solutions that enhance digital financial services for the underserved population worldwide."

Kosta Peric

Deputy Director, Financial Services for the Poor, Gates Foundation

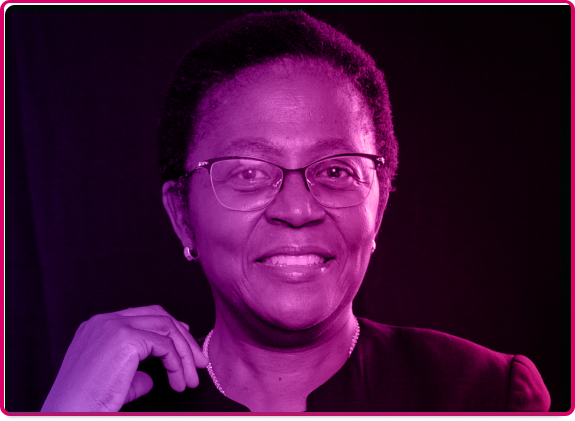

"In my work advancing financial inclusion in Mozambique, the Inclusive FinTech Forum provides crucial insights and partnerships for transformation. This unique space enables us to identify innovative solutions for local challenges. The collaboration between regulators, financial providers, innovators, and development partners directly shapes our strategy for deepening financial access and usage in Mozambique."

Dr. Esselina Macome

CEO, Financial Sector Deepening Mozambique

“Attending the 2025 Inclusive Fintech Forum in Kigali was both inspiring and affirming. It was clear that Rwanda is not just hosting important conversations about financial inclusion and innovation, it is actively shaping them.

At the 2025 forum, I spoke alongside global leaders about how financial centres can collaborate to unlock sustainable growth and broaden access to capital across Africa. I highlighted Kigali’s compelling case as an emerging international finance centre, noting its strategic appeal to investors and its potential as a gateway for funds targeting Africa and beyond.”

Joe Moynihan

CEO, Jersey Finance

"IFF provides a unique vantage point into the Africa-Asia corridor. For Raffles Family Office, the value of this platform lies in its ability to bring together the precise mix of regulators and innovators necessary to drive cross-border capital flow. In Kigali, the dialogue was direct and the objectives were clear. IFF serves as a productive venue for identifying synergies between Asian investment expertise and African fintech potential. It’s a critical link for those of us focused on the “Great Wealth Transfer” and the deployment of capital into high-impact growth. The forum facilitates the high-level exchange required to turn these global shifts into actionable investment strategies."

Chi-Man, Group

CEO Raffles Family Office

"As someone focused on digital financial solutions for underserved communities, I find the Inclusive FinTech Forum invaluable for discovering innovative approaches to financial inclusion. The forum connects philanthropic organisations with startups and regulators, accelerating impactful solutions that enhance digital financial services for the underserved population worldwide."

Kosta Peric

Deputy Director, Financial Services for the Poor, Gates Foundation

"In my work advancing financial inclusion in Mozambique, the Inclusive FinTech Forum provides crucial insights and partnerships for transformation. This unique space enables us to identify innovative solutions for local challenges. The collaboration between regulators, financial providers, innovators, and development partners directly shapes our strategy for deepening financial access and usage in Mozambique."

Dr. Esselina Macome

CEO, Financial Sector Deepening Mozambique

Knowledge Guide to the Inclusive FinTech Forum

Africa's FinTech sector has shown resilience, attracting significant investment and global interest. Proven business models, successful funding rounds, and numerous exits highlight its growth. While the sector offers immense potential, with cash still prevalent in many economies, FinTechs face challenges in navigating regulatory landscapes, building consumer trust, and developing sustainable business models as they mature.

Read our report on driving economic inclusion through technology adoption.

Who Should Attend the Forum?

Policymakers & Government Leaders

-

Join the platform of global fintech standard-setters at IFF 2026 to co-design the next generation of financial regulation

-

Gain insight into emerging trends that influence financial inclusion and digital public infrastructure

Institutional Investors

-

Access to high-quality fintech deal flow

-

Build co-investment partnerships

-

Gain direct regulatory insights

Venture Capitalists & Private Equity Fund Managers

-

Network with corporate buyers, banks, fintechs, regulators, and potential partners

-

Gain practical knowledge on technologies

-

Connect with fintech innovators, banks, and investors who offer SME-enabling solutions

Development Finance Institutions

-

Direct access to investment-ready opportunities and cross-sector partnerships

-

Access to Regulators Shaping the Future of Digital Finance

Fintech & Fintech Associations

-

Improve access to finance, and expand your market reach

- Discover practical fintech solutions that lower business costs

- Meet banks, fintech innovators, policymakers, and investors

Welcoming Our 2026 Partners

Organised By

Lead Partners

.png?width=400&height=200&name=Equity%20-%20resized%20(400%20%C3%97%20200%20px).png)

.png?width=400&height=200&name=Mojaloop%20Foundation%20400x200%20(1).png)

Platinum Partners

.png?width=440&height=240&name=logo_1%20(2).png)

.png?width=400&height=200&name=Swift%20400x200%20(1).png)

Gold Partners

Silver Partners

-1.png?width=400&height=200&name=Ecobank%20(2)-1.png)

.png?width=400&height=200&name=visa_PZF2025%20(1).png)

Exhibition Partners

.png?width=440&height=240&name=logo_1%20(1).png)

Roundtable Partners

.png?width=440&height=240&name=logo_2%20(1).png)

Travel Partners

Community Partners

.png?width=400&height=200&name=Association%20Of%20Fintechs%20In%20Kenya%20(1).png)

.png?width=871&height=451&name=EAVCA@3x%20(2).png)

.png?width=400&height=200&name=Rwanda%20Bankers%20Association%20(2).png)

Media Partners

.png?width=400&height=200&name=CryptoNewsZ%20(400%20x%20200).png)

Knowledge Partners

.png?width=440&height=240&name=logo_2%20(2).png)

IFF 2025 RECORDED SESSIONS

Couldn't make it to Kigali, or want to revisit some of the most IFF 2025’s inspiring keynotes and sessions?

Join Our Community

2026 Featured Speakers

-

Carine Umutoni

Managing Director

Ecobank Rwanda

Carine Umutoni

Managing Director

Mrs. Carine Umutoni is the Managing Director of Ecobank Rwanda Plc.

Mrs. Umutoni has over 19 years of experience in banking and has previously served in senior management roles in the banking sector in Rwanda such as Managing Director of BK Capital, Head of Treasury and Trade Finance at Bank of Kigali, Head of Treasury and Institutional Banking at KCB Rwanda and Head of Treasury and Trade Finance at Banque Commercial du Rwanda (BCR), now I&M Bank Rwanda.

She is also a member of the Agahozo Shalom Youth Village.

She is the holder of an MBA in Corporate Strategy and Economic Policy from Maastricht University, Netherlands. -

David Nandwa

Founder & Chief Executive Officer

HoneyCoin

David Nandwa

Founder & Chief Executive Officer

David Nandwa is a serial entrepreneur and CEO @ HoneyCoin, before HoneyCoin he's worked as a software engineer at or with leading companies like Flutterwave and Andela. He's started, scaled, and exited two ventures prior to HoneyCoin and has a passion for finance and building real-world solutions to hard problems on the continent. David has raised millions of dollars in funding from investors such as Visa, TLCom, Flourish Ventures, Antler and more and has scaled HoneyCoin to over $100M per month volume as of 2025.

-

Deon Woods Bell

Senior Advisor, Global Policy & Advocacy

Gates Foundation

Deon Woods Bell

Senior Advisor, Global Policy & Advocacy

Deon Woods Bell is a Senior Advisor, Global Policy and Advocacy at The Gates Foundation. She leads policy and multilateral engagement for the Digital Public Infrastructure and Inclusive Financial Systems teams, representing the foundation across major global institutions including the United Nations, World Bank, G20, and African Union. Earlier foundation accomplishments include spearheading efforts related to the African Continental Free Trade Agreement (AfCFTA) Digital Trade Protocol, South African G20 Digital and Financial Inclusion Working Groups as well as the UN Digital Public Infrastructure Safeguards Initiative. She serves on the foundation's AI Task Force, and her portfolio also includes cross-border policy harmonization related to digital transactions, women’s economic power, artificial intelligence, and cybersecurity.

Deon previously served as attorney-advisor and senior international counsel at the U.S. Federal Trade Commission, leading global consumer protection, privacy and data security technical cooperation and serving as an expert to the United Nations and the Organization for Economic Co-operation and Development (OECD). She also has held positions at the U.S. Department of Commerce, an international law firm, and Fortune 500 companies, with her pro bono work centered on human rights advocacy and environmental justice.

On behalf of the Gates Foundation, Deon serves on advisory bodies including the United Nations Better Than Cash Alliance (BTCA), the World Bank’s Consultative Group to Assist the Poor (CGAP), the Digital Impact Alliance (DIAL), and the UK International Centre for Tax and Development (ICTD). She also serves on the American Bar Association House of Delegates, Center for Innovation Governing Council/AI Task Force, and on advisory boards of the Partnership on Open AI, American University’s School of International Service, and the Smithsonian Women’s Committee.

Deon earned her J.D. from the University of Chicago Law School, where she served on the Law Review. She holds a Master’s in Economics from the University of Michigan and a triple-major B.A., cum laude (International Relations, Economics, and Latin American Studies), from American University. She was a Fulbright Scholar and completed advanced study in Political Economy and Government at Harvard University. She was proudly a U.S. election monitor during President Nelson Mandela’s historic election in South Africa.

Deon speaks Spanish, French, and Sign Language. She has lived, worked, and traveled extensively across Africa, Asia, Europe, Latin America, and the Middle East. In her spare time, she enjoys dancing, reading, listening to podcasts, and enthusiastically supporting her three children’s soccer, basketball, and volleyball teams. -

Fadilah Tchoumba

Chief Executive Officer

ABAN

Fadilah Tchoumba

Chief Executive Officer

Fadilah Tchoumba is the CEO of ABAN and the fund manager for Catalytic Africa, a co-investment facility for early-stage startups in Africa. She also serves as the Director of the African Business Angel Vehicle, a fund focused on sector-specific ventures. Additionally, Fadilah is a founding member and senior analyst at Amzill, a data collection and analysis firm, and she is on the advisory board of ENRICH in Africa.

Before joining ABAN, Fadilah managed investment portfolios for institutional investors with interests in African trade. She also served as Director of Business and Innovation for the Royal Commonwealth Society, where she led the development of innovative projects aligned with Commonwealth values.

Fadilah has been instrumental in creating tech-driven funds for innovative startups, including sharia-compliant vehicles, establishing herself as a leader in alternative asset classes in Africa. Passionate about innovation and sustainability, she advocates for early-stage investing, cross-border investments, and policy development to drive success in Africa’s entrepreneurial ecosystem.

Fadilah holds a BA in Economics and Philosophy from Connecticut College, a diploma in International Commerce and Trade from Georgetown University, and a Master’s degree from the London School of Economics. -

Henry Saamoi

Executive Governor

Central Bank of Liberia

Henry Saamoi

Executive Governor

Mr. Henry F. Saamoi is a distinguished commercial banker with over twenty-five years of industry experience. His career commenced in 1998 as an intern at the Liberia Bank for Development and Investment (LBDI). He subsequently transitioned to the International Trust Company (ITC) to complete his internship. Following his graduation from the University of Liberia in 1998, he secured a permanent position in 1999 with ITC as a Staff Analyst in the Finance & Accounting Department of ITC's Maritime & Corporate programs. It is noteworthy that in 1999, ITC was dissolved, and its Banking Department was rebranded as International Bank (Liberia) Limited.

In 2000, Mr. Saamoi was rehired as a Senior Financial Analyst in the Finance Department of International Bank (Liberia) Limited (IBLL). Demonstrating exceptional skills and leadership, he rapidly ascended through various roles within the bank and was appointed as the Chief Executive Officer (CEO). He officially retired as CEO of IBLL on May 31, 2024. His retirement comes after nearly twelve successful years at the helm, following a special dispensation from the Central Bank that allowed him to continue serving beyond the standard ten-year tenure required by the CBL Corporate Governance Regulation.

He has been recognized with prestigious awards, including the Industry Personality of the Year in Banking at The Africa Summit Awards in London in 2018, presented by the African Leadership Magazine. Additionally, he is the proud recipient of the Distinguished Banking Personality Excellence Award, which he received at the African Leadership Magazine's Persons of the Year Awards Ceremony, held in Addis Ababa, Ethiopia, on March 14-15, 2024.

Under his leadership at International Bank (Liberia) Limited (IBLL), IB was recognized by Banker International Magazine as the Best Innovation in Retail Banking and the Best Commercial Bank in Liberia at the 2018 Banking Awards, held at the London Stock Exchange in London.

He is a graduate of the School of Banking, University of Wisconsin in Madison, USA. He holds certificates in International Finance Reporting Standards (IFRS) and Trade Finance from the International Finance Corporation, complemented by his participation in several prestigious workshops organized by the World Bank, both within Liberia and internationally. Until his retirement on May 31, 2024, he served as the Vice President of the Liberia Bankers Association, showcasing his leadership and expertise in the banking sector.

On July 30, 2024, Mr. Saamoi was appointed by His Excellency, Ambassador Joseph Nyuma Boakai, Sr., President of the Republic of Liberia, to serve as Acting Executive Governor of the Central Bank of Liberia and was appointed Executive Governor on February 5, 2025. -

Hilda Moraa

Founder & Chief Executive Officer

Pezesha

Hilda Moraa

Founder & Chief Executive Officer

Hilda is an award-winning entrepreneur and author. She has more than 15 years of entrepreneurship experience in Fintech and working with multinationals supply chain firms like Coca-Cola to develop innovations across Africa. She is a unique forerunner in many ways, including the fact that her first tech start-up was the first recorded multi-million dollar exit in the Kenya ecosystem – way back in 2015. This exit catapulted the ecosystem as entrepreneurs and techies saw what was possible. She is currently the Founder & CEO of Pezesha, a holistic digital financial infrastructure powering working capital and credit scoring to SMEs and institutions across Africa. Pezesha is using more than 100 million points of data, and has disbursed over 500,000 SME loans. She has been profiled by Bloomberg as one of the Bloomberg LP New Economy Catalysts in 2023. Most recently in early 2024, she was awarded the winner of the Tech & Innovation by Forbes Woman Africa. She is also the newly appointed UN (United Nations) UNCTAD, - eTrade for Women Advocate for English-speaking, Africa region 2024-2025.

-

Hortense Mudenge

Chief Executive Officer

Kigali International Financial Centre

Hortense Mudenge

Chief Executive Officer

Hortense MUDENGE is the Chief Executive Officer of Kigali International Financial Centre, the agency promoting and developing Rwanda as a leading financial destination for international investment and cross-border transactions in Africa.

Hortense is a seasoned management consultant, with over 12 years of experience in private sector development and finance.

Hortense holds an MBA from Hult International Business School in the US and is a graduate of the United States International University- Africa. -

Innocent Kawooya, NIM

Chief Executive Officer

HiPipo

Innocent Kawooya, NIM

Chief Executive Officer

My name is Innocent Kawooya, NIM, a co-founder and CEO of HiPipo, a digital innovation and financial inclusion company founded in 2005. HiPipo is a leading champion of digital and financial inclusion across Africa and is widely recognised for advancing Instant, Inclusive Payment Systems (IIPS) under the HiPipo Include Everyone Program, working with governments, regulators, FinTechs, and development partners across the COMESA region and beyond.

I am a FinTech and financial inclusion specialist, women empowerment advocate, internet entrepreneur, computer programmer, film producer, humanitarian, and entertainment executive. In 2021, I stood as a Kampala City Lord Mayoral candidate, driven by a vision of inclusive urban development and digital transformation.

I have received multiple recognitions for leadership and impact, including CEO of the Year 2021–2022 by TIG Network Afrika and FinTech CEO of the Year (MEA Region) for 2024 and 2025. In October 2024, I was awarded the Presidential Diamond Jubilee, National Independence Medal by H.E. the President of Uganda for contributions to digital and financial inclusion. In 2023, the Mojaloop Community Council voted me Co-Chair for the second time in three years.

HiPipo has been ranked among the World’s Top 20 Companies Escalating Innovation in Digital Financial Services by Global Business Leaders Magazine and named Best Financial Inclusion Organisation in East Africa at the FinTech Awards 2022 and 2023, and awarded Financial Inclusion Organisation of the Year in the MEA Region for 2024 and 2025 by Wealth & Finance International.

Through initiatives such as Digital Impact Awards Africa (DIAA), HiPipo Music Awards, Women in FinTech, 40 Days 40 FinTechs, My Doctor (telemedicine), Solar M7 (clean energy access), and HiPipo University, my work focuses on building practical, scalable solutions that expand access to health, finance, energy, education, wealth and opportunity for millions of people across Africa.

#MadeOfGOD -

Kosta Peric

Deputy Director, Inclusive Financial Systems

Gates Foundation

Kosta Peric

Deputy Director, Inclusive Financial Systems

Experienced executive at the intersection of technology, finance and innovation. Focus on digital financial inclusion at the Gates Foundation. Board chair at the Mojaloop Foundation and board member at the Interledger Foundation. Former Chief Architect at Swift. Author: The Castle and the Sandbox.

-

Marcus Davis

Deputy Director

Central Bank of Liberia

Marcus Davis

Deputy Director

Marcus N. Davis is Deputy Director of the Payment Systems Department at the Central Bank of Liberia (CBL). He plays a central role in driving Liberia’s payments modernization agenda, including the implementation of the National Electronic Payment Switch (NEPS) to achieve cross-domain interoperability. Marcus leads stakeholder coordination with mobile network operators, financial institutions, and international partners. His work is focused on advancing financial inclusion, improving digital public infrastructure, and strengthening payment system oversight. With extensive experience in financial services, policy, and program delivery, Marcus is passionate about building secure, inclusive, and sustainable digital finance solutions for Liberia.

-

Mary Ellen Iskenderian

President & Chief Executive Officer

Women's World Banking

Mary Ellen Iskenderian

President & Chief Executive Officer

Mary Ellen Iskenderian is the President and CEO of Women’s World Banking, a global nonprofit dedicated to serving the nearly one billion women excluded by the formal financial sector. She joined Women’s World Banking in 2006 and leads its global team in partnering with financial institutions and policymakers around the world to design and develop solutions and programs that facilitate systemic change for women. Additionally, she oversees Women’s World Banking’s asset management business that makes direct equity investments in financial service providers as a means to advance women in the workplace and as customers.

Mary Ellen is a passionate advocate for women’s economic empowerment through greater access to finance; she urges the financial services industry and business community to view low-income women as a powerful new market of small business owners, heads of households, and consumers of financial products and services.

Mary Ellen has spoken widely and published extensively on topics ranging from equality of economic opportunity, women’s financial inclusion, climate resilience, and financial abuse. In April 2022, her first book, “There’s Nothing Micro About a Billion Women: Making Finance Work for Women,” was published by MIT Press.

Before joining Women’s World Banking, Mary Ellen worked for 17 years at the International Finance Corporation, the private sector arm of the World Bank, and had previously worked for the investment bank Lehman Brothers. She is a permanent member of the Council on Foreign Relations, serves as a Director on the Board of the William and Flora Hewlett Foundation, and is a member of the World Economic Forum’s Global Future Council and of Milken’s Africa Business Leaders Council.

A 2017 Rockefeller Foundation Bellagio Center Fellow, Mary Ellen holds an MBA from the Yale School of Management and a Bachelor of Science in International Economics from Georgetown University’s School of Foreign Service. -

Natalie P. Jabangwe

Chief Executive Officer

Timbuktoo Africa Innovation Foundation

Natalie P. Jabangwe

Chief Executive Officer

Natalie Jabangwe is the CEO of the Timbuktoo Foundation, that houses a $1bn start up fund, a leading organization focused on driving innovation across Africa. Under her leadership, the foundation has become a key player in empowering young innovators and entrepreneurs, fostering creativity, and promoting sustainable development through technology and education.

Before joining Timbuktoo, Natalie served as the Group Digital Executive Officer at the Sanlam Group, Africa’s largest non-bank financial company in Africa and overseeing 34 countries and a budget of $600m. From 2014-2021, she was CEO of EcoCash, Zimbabwe’s largest mobile money service, where she was one of the youngest female CEOs in Africa’s mobile financial sector. Her career has been marked by her commitment to leveraging technology to create impactful solutions, earning her recognition as a Young Global Leader by the World Economic Forum in 2018. Natalie is also a 2017 Oxford University Tutu Fellow, reflecting her leadership and influence across Africa. -

Ola Oyetayo

Co-Founder

Verto

Ola Oyetayo

Co-Founder

Ola Oyetayo is the Co-Founder and CEO at Verto. With a robust background in finance, consulting, and entrepreneurship, Ola’s career includes significant roles at American Express, Barclays, and Lloyds Bank.

Ola’s educational journey began in Nigeria, where he completed his early education. He then studied Economics and trained as an Accountant.

Ola was inspired to found Verto by the challenges he observed some of his friends facing when making international business payments. It became apparent that businesses located in emerging markets often encountered difficulties in executing seamless cross-border transactions. Always drawn to solving large-scale problems, Ola gravitated towards addressing this issue, leading to the establishment of Verto with the vision to facilitate smoother global commerce.

Under Ola’s leadership, Verto was awarded the Fintech of the Year 2022 at the London Fintech Awards. Outside of work, Ola enjoys reading and playing golf. -

Dr. Patrick Njoroge

Former Governor

Central Bank of Kenya

Dr. Patrick Njoroge

Former Governor

Dr. Patrick Njoroge served as the ninth Governor of the Central Bank of Kenya from June 2015 to June 2023, after a 20-year career at the International Monetary Fund. He is currently a member of the Advisory Boards of the "Yale Program on Financial Stability" and the "Global Finance and Technology Network," chair of the "Africa Financial Industry Summit" (AFIS) Supervisory Council, and a member of the Africa Expert Panel for South Africa’s G20 Presidency. He has received several awards and recognitions, including four awards for Africa’s Central Banker of the Year, and recognition in 2023 as a Top 25 African Finance Leader. He holds a PhD in Economics from Yale University. He is MLK, Jr. and Phyllis Wallace Visiting Scholar at the MIT Sloan School of Management.

-

Hon. Paula Ingabire

Minister of ICT & Innovation

Republic of Rwanda

Hon. Paula Ingabire

Minister of ICT & Innovation

Paula Ingabire is Rwanda’s Minister of ICT and Innovation. Before she was appointed Minister, she served as Head of the Technology portfolio under the Rwanda Development Board (RDB) where she led the implementation of National ICT programs notably eGovernment and Cyber Security. She also served as the coordinator of the Kigali Innovation City Project, a flagship program of the Government designed to nurture and strengthen a Pan-African Innovation eco-system in Rwanda.

Minister Ingabire coordinated the creation of Smart Africa, an initiative that seeks to drive coordinated digital transformation across African member states that are part of the Smart Africa Alliance. Today, Smart Africa has 40 African member states that have joined the Alliance.

A graduate of the Massachusetts Institute of Technology’s School of Engineering & Sloan School of Management, in the System Design and Management program; Paula was named among the young Global Leaders in 2020. She serves on the WEF Board of Trustees, Global Council of the World Summit Award Board of Directors, World Economic Forum Cyber Security Board, the Centre for the Fourth Industrial Revolution Global Network Advisory Board, and she serves as a founding board member of the EDISON Alliance. -

Sabine F. Mensah

Deputy Chief Executive Officer

AfricaNenda Foundation

Sabine F. Mensah

Deputy Chief Executive Officer

Sabine F. Mensah has over 25 years of leadership experience in financial inclusion, digital payment systems and mobile money across multilaterals and the private sector in Africa, US, and Canada. Since July 2021, as the Deputy CEO, Sabine oversees AfricaNenda’s policy, advocacy, and capacity development efforts through strategic partnerships, convenings and thought leaderships. Prior to AfricaNenda, Sabine served 6 years as Regional Digital Hub Manager for the United Nations Capital Development Fund UNCDF in West and Central Africa, working on financial inclusive and digital economy. She successfully drove UNCDF’s global digital infrastructure workstream during her tenure. Sabine also consulted for the mobile money industry in Africa working with telecommunication groups and DFS consulting firms on projects accross Africa. She built 15 years expertise in the remittance industry in Africa, US, and Canada with the Western Union Company. As the Regional Director responsible for domestic and international remittances at Western Union Canada, she specialized in agent network management and remittance product design. Sabine is a Certified Digital Finance Practitioner by DFI, and an alumna of the Institut Franco-Américain de Management in France and Central Michigan University in the US. She is bilingual English-French.

-

Dr. Segun Aina

President

Africa FinTech Network

Dr. Segun Aina

President

Dr Segun Aina is a global professional banking leader, internationally rated fintech ecosystem builder and respected futurist.

With three decades of distinguished banking career in three banks including six-year tenure as Bank Chief Executive Officer, Dr Aina is the inaugural Chairman of Global Banking Education Standards Board (GBEStB), former Chairman of Accion Bank Nigeria, Odua Investment Co Ltd, former Director of First Atlantic Bank Ghana, among other past board positions. He served as 17th President of Chartered Institute of Bankers of Nigeria.

He is the founding President and currently Chairman, Board of Trustees of Fintech Association of Nigeria (FINTECHNGR), founding President of the Africa Fintech Network (AFN) , founding member of the Board of Global Fintech Alliance and pioneer Chairman of International Digital Economies Association (IDEA)

In these roles, he has championed, coordinated, and led advocacy and initiatives aimed at improving financial and payment systems, banking regulations, financial literacy and innovation in financial services across Africa and globally.

As an innovation ecosystem builder, Dr Aina who has been variously described as Africa's Fintech Grandmaster, has incubated a number of successful fintech startups and sits on the Boards of various institutions in Banking, Insurance, Agriculture and Technology sectors. He also serves as a member of the UK- Africa Fintech Investment Group, a UK Govt initiative.

Dr Aina's unique contributions to the academic sector includes membership of the pioneer Advancement Board of Obafemi Awolowo University and currently Chairman Advancement Board of Federal University of Technology Akure, co-Chairman National Think Tank on Research for Innovation and Policy (initiative of University of Ibadan Research Foundation of which he is a member) and Member, Osun State University Advancement Board.

Dr. Aina is a distinguished alumnus of University of Lagos and University of Ibadan and had executive business education in INSEAD France, Harvard Business School (HBS), IMD Switzerland, and the Lagos Business School (LBS). He is Fellow of London Institute of Banking and Finance, Chartered Institute of Bankers of Nigeria, Charteted nstitute of Directors, Institute of Chartered Arbitrators among others.

He holds the Nigeria National honours of Officer of the Order of Federal Republic (OFR) since and has received honorary doctorate degrees from four renowned Universities. -

Serigne Dioum

Chief Executive Officer

MTN Fintech Group

Serigne Dioum

Chief Executive Officer

Serigne Dioum is the Group CEO of MTN Group Fintech, where he leads the company’s mission to build Africa’s largest and most inclusive digital financial services platform. Since joining MTN in 2009, he has driven the expansion of MTN MoMo to 14 African countries, serving over 63 million customers and enabling transactions worth over US$212 billion in the first half of 2025. Under his leadership, MTN Fintech achieved a landmark US$5.2 billion valuation through a strategic partnership with Mastercard. A telecommunications engineer by training, Serigne is passionate about using digital innovation to drive financial inclusion and economic growth across Africa.

-

Sopnendu Mohanty

Group Chief Executive Officer

Global Finance & Technology Network (GFTN)

Sopnendu Mohanty

Group Chief Executive Officer

Sopnendu Mohanty is the Co-founder and Group CEO of the Global Finance & Technology Network (GFTN), a global advisory and investment firm. At GFTN, he leads innovative strategies that drive development and transformation in the financial sector through four operating arms: Forums, Advisory, Platform, and Capital.

He served at the Monetary Authority of Singapore (MAS) as its first Chief Fintech Officer for nearly a decade, establishing Singapore on the global map as a leading center for innovation in the financial sector and a dynamic hub for fintech development. He continues to advise MAS on technology and innovation.

He currently serves on several boards, including the board of A*STAR, Singapore’s leading public sector agency dedicated to advancing scientific discovery and technological innovation. Before his leadership role in the public sector, he spent nearly two decades at Citigroup. He is credited with developing many public goods, including the notable PayNow, Singapore’s digital public infrastructure for payments. He conceptualized the globally well-known Singapore Fintech Festival and its global network of forums; today, the GFTN forum is the world’s largest convenor of tech, policymakers, and the financial sector community. Mr. Mohanty has co-authored several patented works in digital finance and received numerous industry accolades. He advises governments and various institutions on policies and implementation strategies for innovation, infrastructure, and ecosystem development in the financial sector. -

Hon. Soraya Hakuziyaremye

Governor

National Bank of Rwanda

Hon. Soraya Hakuziyaremye

Governor

Hon. Soraya Munyana Hakuziyaremye was appointed Governor of the National Bank of Rwanda on February 25th, 2025. Prior to this role she was Deputy Governor of the National Bank of Rwanda since March 15, 2021. Hon. Soraya was also appointed as Chair of the Alliance of Financial Inclusion (AFI) Board of Directors on September 3rd, 2025.

She served as Minister of Trade and Industry from October 2018 to March 2021, in Rwanda, where she led the implementation of the Made in Rwanda policy, contributing to a 9% average annual growth in the industry sector and a significant increase in exports. During her tenure, she also chaired the EAC Sectoral Council on Investment and Trade, playing a key role in the entry into force of the African Continental Free Trade Area Agreement (AfCFTA). Additionally, she was a member of Rwanda’s National COVID-19 Taskforce, overseeing the management of domestic and cross-border trade flows during the pandemic.

Before joining the Cabinet, Hon. Soraya held several senior roles in international banking and finance. From 2016 to 2018, she was Vice President in the Financial Institutions/Financial Markets Risk Department at ING Bank in London. She also previously worked in senior risk management positions at BNP Paribas Group in Paris, Fortis Bank, and the Bank of New York Mellon in Brussels between 2002 and 2011. From 2012 to 2014, she served as Senior Advisor to the Minister of Foreign Affairs in Rwanda.

In addition to her leadership in finance and government, Hon. Soraya has played an active role in corporate governance and investment initiatives. She was a Board member at Ngali Holdings and co-founded the Brussels-Africa Hub, an international non-profit organization led by banking and finance professionals to facilitate sustainable and responsible investments in Africa.

Hon. Soraya brings rich leadership experience in global banking and financial advisory, combining expertise in financial markets, risk management, and economic policy. She holds a postgraduate degree in International Management from the Thunderbird School of Global Management at Arizona State University (U.S.) and a Master’s in Business Engineering (Ingénieur de Gestion) from the Solvay Business School at the Université Libre de Bruxelles (Belgium). She is also an alumna of the Executive Public Leaders Program at the University of Oxford’s Blavatnik School of Government. -

Steve Haley

Director of Market Development & Partnerships

Mojaloop Foundation

Steve Haley

Director of Market Development & Partnerships

Steve has led diverse impact-driven teams for 22 years in over 10 countries between work in the government, non-profit and the private sector. He aims to influence a more equitable and fair world, particularly through inclusive financial services. At the Mojaloop Foundation, he is driving interoperable real time payments that reach everyone by helping various stakeholders to understand their role in building locally owned, locally controlled, and locally operated payments infrastructure. He holds degrees in Mathematics from West Point and the University of Padova.

-

Yemi Keri

Co-Founder

Rising Tide Africa & Heckerbella Limited

Yemi Keri

Co-Founder

Yemi Keri is a technology executive, board leader, and angel investor with over 24 years of experience shaping digital transformation, innovation, and investment across Africa’s public and private sectors. Recognized as one of Nigeria’s foremost women in technology, she has consistently delivered solutions that drive business growth, socio-economic development, and increased participation of women in early-stage investing.

She is the Co-Founder of Rising Tide Africa, a women-led platform advancing cross-border angel investing and investor mentorship, and the CEO of Heckerbella Limited, a technology solutions company delivering scalable and sustainable IT innovations across the continent. Through these roles, she champions education, strategic collaboration, and indigenous digital transformation initiatives.

Yemi serves on the boards of First City Monument Bank (FCMB), Investment One Financial Services, GAIA Africa, Beyond Credit Limited, Nigeria Climate Innovation Centre, and M&E Kaiser Limited.

She is the President of the Nigerian-German Chamber of Commerce (NGCC), President of the African Business Angel Network (ABAN), Chair of the Board of Governors of the Lagos Angel Network, and a member of the Investment Committee of Acumen’s Resilient Agriculture Fund (ARAF).

In academia and mentorship, Yemi is an Expert-in-Residence at the Enterprise Development Centre (EDC) and a facilitator on Corporate Governance and Digital Technology & Trends at Pan-Atlantic University/Lagos Business School. She continues to mentor digital and technology-enabled startups across Africa, shaping the next generation of leaders and investors.

Alfred Hannig

Chief Executive Officer

Alliance for Financial Inclusion

Alfred Hannig

Chief Executive Officer

Dr. Alfred Hannig is the Executive Director of the Alliance for Financial Inclusion (AFI), a global network of policymaking and regulatory institutions from more than 90 countries, dedicated to providing the world’s unbanked safe access to the formal financial system through smart policy initiatives.

Dr. Hannig is a member of the AFI Board of Directors and heads the AFI Management Unit. Prior to his work with AFI, he served in leading management, policy advisory, training and research focused positions around the world including assignments with: Bank Indonesia, Bank of Uganda, Superintendencia de Bancos in Bolivia; Head of the Financial Systems Development Unit at German Technical Cooperation, and with the German Ministry for Economic Cooperation and Development (BMZ).